Small business loans are not as difficult as asset finance from the lender organization. You can avail of it freely with authentic documents. You can approach a company with your business documents. Have a professional conversation with a lender or a broker to put a great impression like an owner of a great company. Somehow, they will take their tie to select you for the loan giving opportunity. Once you are verified, you will be called again for an interview. Give your 100% to be selected for a loan. Probably, there will be no chance left to give you nothing in your struggle.

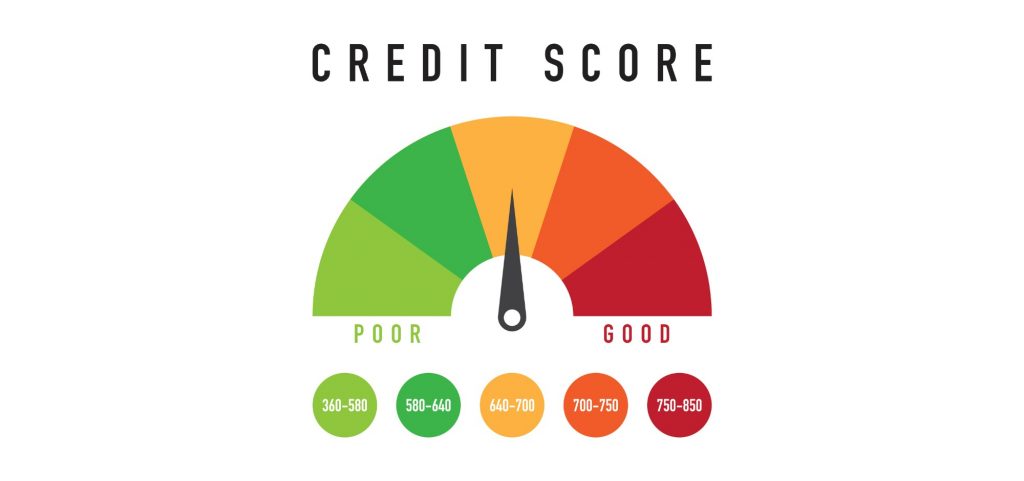

1. Credit Score

Do you know about credit scores? Well, it is about your business credit score that you have earned since its establishment. The score should be around 80% to get selected for a loan. That credit score will help the organization to understand and identify your ability to build revenue in a short time. That revenue score will remark your performance in the market. If you are still in between 60%, you can improve your scores. That score is your backbone and you cannot appear without it. Understand its importance to generate revenue every month.

2. Lender’s Requirements

To get accepted, you have to interview the lender as well. Ask him for a lunch and talk to him about your future goals and other stuff. If you are interested in building the network chain of your business, it is time to check the availability. That availability will assist you to accept the requirements of the lender. Maybe, he can ask you a few more questions with the proof. Put your authentic replies with the proof. That is the initial position of building trust with great leaders. Take his advice seriously for your business too.

3. Tax Registration

The registration of your tax history should be verified and registered in the national authoritative company. You can take a hard copy of the entire history of the tax registration every month and submit it to the lender’s office. He will check the GST amount on your campaigns. You can also trust him while discussing the deceased expenses and the right solution. A good broker or a lender can suggest an experienced strategy to decrease the number of expenses in one row. If there is something teasing your transaction, contact the registrar of your company to solve it soon.

4. Analysis

An individual with experience in internships should grow practically through analysis. You can simply analyze the market rate and its trends to know what is exactly happening inside the industry. Understand the success story of an industry. Once you are done finding a way for the business, you can build it effectively with collaboration. Whenever you have small investment money, make sure to join hands with other companies for collaboration. That technique will help you find the way to reach the destination. Plan the facilities that you will provide to your employees as well.